When Kansas City takes on San Francisco this Sunday, Americans will sit down to not just watch the Super Bowl but to take in all the Super Bowl ads. It’s a hallowed, buzzy, and fun tradition involving the world’s biggest brands, the heartfelt alongside the humorous, and more celebrities than a Vanity Fair party. It doesn’t come cheaply, either.

The going rate for a 30-second spot in this year’s game is $7 million. So let’s say a brand decided to forgo their annual Super Bowl ad and poured that money into a radio campaign – how much comparative bang would they get for their buck?

A custom Nielsen survey, commissioned by the NFL, estimated 200 million viewers (around 60% of the US population) watched Super Bowl LVII in 2023. That $7 million buy gets each brand a single spot play. But reach by itself isn’t enough. As any radio seller can tell you, any successful campaign must also have frequency.

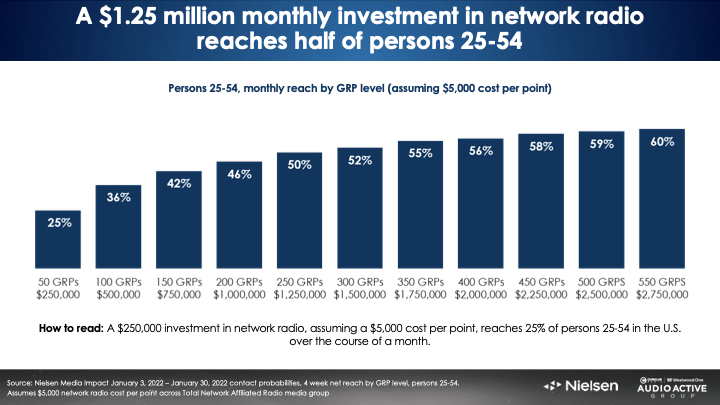

Analysis by Nielsen Media Impact reveals that with a $6.47 million investment, advertisers can launch a campaign that would connect with 155.6 million Americans (around 56% of the nation’s population), each month for three months.

$6.47m in network radio translates to 400 Gross Ratings Points monthly, maintaining a consistent reach to over half of the US populace. And there’s still a half million dollars left over.

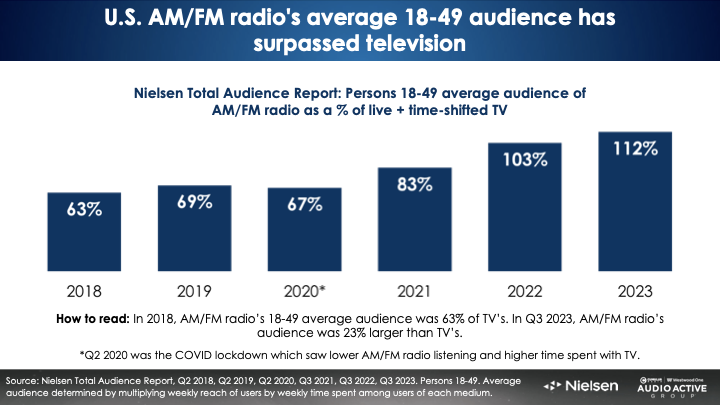

Of course, most brands will continue to televise their Super Bowl commercials for weeks after the game is over, at additional cost. While these buys come at a lower cost, this strategy also won’t reap the dividends it once would.

The Nielsen Q3 Total Audience Report highlighted a 29% drop in TV’s 18-49 reach and a 62% decrease in viewing time since 2018. In contrast, AM/FM not only reaches 40% more people aged 18-49 weekly compared to TV but also matches TV in daily time spent by the same demographic. Traditional radio now surpasses TV by 12% in average rating among the 18-49 age group, marking a significant shift from 2018 when TV held the lead.

On the flip side of the audio coin, Libsyn AdvertiseCast CPM rates show that if a brand put that $7 million Super Bowl ad buy into podcast advertising, they could net 300 million impressions through 60-second host-read ads on podcasts, offering a highly targeted approach.

The comparison between network radio and television audiences, particularly in the context of declining TV viewership, underscores the growing value of radio as an advertising medium.

Our thanks to Cumulus Media Chief Insights Officer Pierre Bouvard for his assistance with this story.

Interesting story, but it’s all theoretical and we’re not sure what the point is.

Major advertisers do not buy ads in the Super Bowl with advertising efficiencies in mind. They buy ads for corporate ego, and more importantly (to them) for a 1x massive, massive reach with a branding message. And although this thinking can certainly be questioned, the vast majority of the 100 million plus audience will see the commercial; most watch the broadcast both for the commercials and the game.

So this story, though with an A for effort, is comparing apples to oranges.