As the first half of 2023 winds down, radio is hoping for a better Q3 and beyond, but will that happen? It could be a leaner finish to the year according to a revised 2023 forecast from BIA Advisory Services.

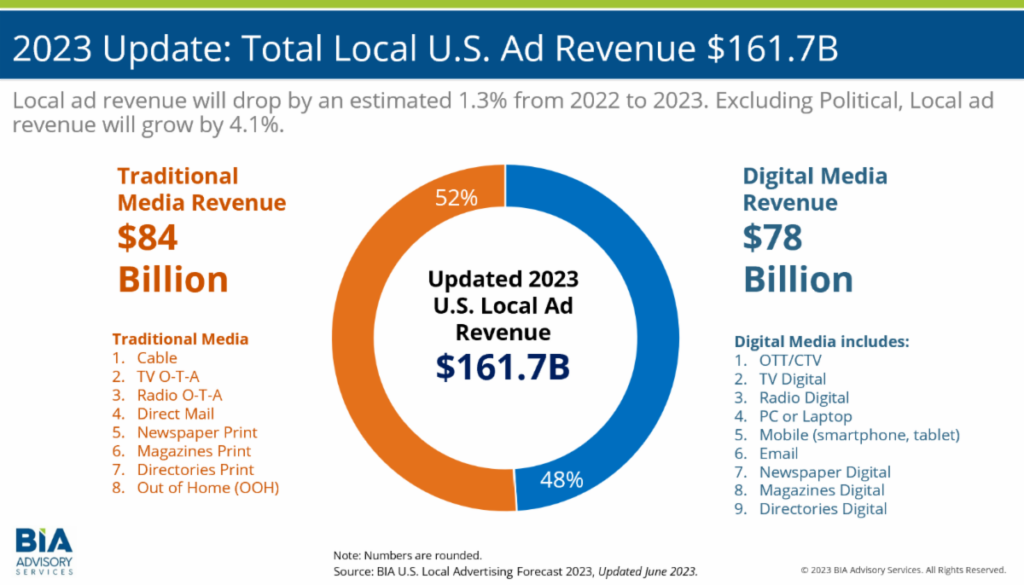

BIA adjusted its 2023 US Local Advertising Forecast from $165.7 billion to $161.7 billion, attributed to the mixed economic start this year and the tempered growth in digital advertising.

BIA VP Forecasting and Analysis Nicole Ovadia explains, “After years of double-digit growth, we are seeing some headwinds that will have a significant impact on digital local advertising. For traditional media, while we’ve made changes to certain media and categories throughout our forecast, the total ad forecast for this segment remains consistent with our original expectations.”

Of those revised numbers, traditional media is projected to earn $84 billion, while digital revenue is revised to $78 billion, down from the original estimate of $81 billion.

So where does that leave radio?

OTA Radio’s local ad revenue is expected to finish at $10.4 billion. That’s down 3.9%, removing political. Compare that to the 1.4% hit that was first forecast in November of 2022, and it means a large loss for the industry. Those hits will keep on coming, as losses of 1.4% are now expected in 2024 and 1.0% in 2025.

What about radio’s digital arm?

“After Meta, Alphabet and others lowered expectations for 2023, we examined local digital advertising spending revenues over the first six months of the year and determined a reduction was necessary,” said Ovadia. Despite the major tech companies prepping for a blow, radio’s digital revenue will reach $2.8 billion – a 4.1% gain, before political.

Regarding top spending sub-verticals, BIA anticipates growth later in the year in areas such as Auto, particularly in New Car Dealers and Automotive Repair Services. Other verticals where expectations are raised include Savings/Credit Institutions and Other Loan Services, Plumbers and HVAC, and Realtors. While political advertising is expected to dominate in 2024, some spending is anticipated to commence in 2023.

The updated forecast also reflects lower estimates for Online Gambling, Office Supplies and Stationery Stores, Auto & Direct Property Insurance, and Health & Personal Care Stores.

The updated forecast, which covers 16 media and 96 sub-verticals, is now available on the BIA ADVantage platform, with updates to local television revenue in the MEDIA Access Pro database.