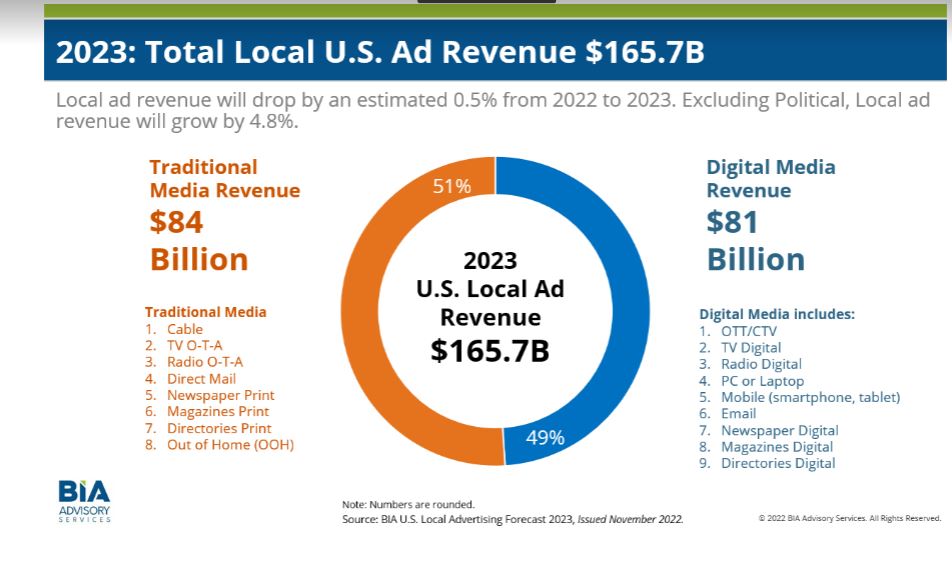

In its newly released 2023 U.S. Local Advertising Forecast, BIA Advisory Services estimates revenues across all media will reach $165.7 billion in 2023, a drop of 0.5 percent from BIA’s final estimate of $166.5 billion for 2022. When backing out political revenue, BIA projects $165.2 billion in total local advertising next year, a 4.8% increase over 2022.

BIA is forecasting radio to finish 2023 at $13.5 billion and that includes both over-the-air and digital. The BIA projection, if true, would result in a 4% decrease over BIA’s final projected 2022 number. 2022 was a heavy political year so when you back out $5 billion in 2022 political revenue, local revenue will be flat.

The top three paid media channels for 2023 include direct mail ($37.2B), mobile ($33.5B), and PC/Laptop ($29.0B). As we’ve previously reported, direct mail’s growth has been slowing substantially and is expected to continue that pattern at +1.5% in 2023 due to rising costs and the continued growth across all digital channels. TV Digital, Over-the-Top (OTT), and Mobile will rise +17.3 percent, +12.3 percent, and +8.1 percent respectively, with TV digital growing from a smaller base than the other media.

“This year has been filled with contrasting economic indicators creating several challenges for the local advertising marketplace,” said Nicole Ovadia, VP Forecasting & Analysis, BIA Advisory Services. “Supply chain issues continued to plague the first couple of quarters of 2022 making it difficult for local media sellers. In the summer, we had higher hopes for the remainder of the year; however, inflation issues and recession fears started to set in and that stalled anticipated rebounds in key verticals such as automotive.”

The 2023 forecast shows digital continues to gain on traditional media, growing its share to 49 percent of the overall advertising spend at $81 billion. Traditional media ad revenue is 51 percent of the ad spend at $84 billion. BIA has been slightly decreasing its digital estimates over the last couple of forecasting rounds because of opt-in privacy measures on Apple and Android devices that have slightly impacted mobile advertising growth.

The business verticals that are expected to grow, according to BIA’s 2023 U.S. Local Advertising Forecast are: education (9.7 percent), retail (8.7 percent) and, restaurants (7.5 percent). Notable declining verticals include political (-78 percent), leisure and recreation (-4.9 percent) and real estate (-1.0 percent). The automotive vertical is projected to grow 4.9 percent, but not until the latter part of 2023.

BIA is hosting the public webinar, Top Recession-Proof Verticals for 2023, on Wednesday, Nov. 30 at 2 pm to examine opportunities for local sellers. Registration is free and can be watched on-demand after its airing using the same link.