On February 23, iHeartMedia Chairman/CEO Bob Pittman was scheduled to be on stage in Music City USA as the Country Radio Seminar kicks off day one, in-person, in Nashville.

He began the day bright and early, with a 7:30am Central start time for the company’s Q4 2021 earnings call, which began minutes after the release of the iHeart fiscal health report.

How did iHeart do? “We’re delighted to report another strong quarter,” Pittman said.

He wasn’t exaggerating.

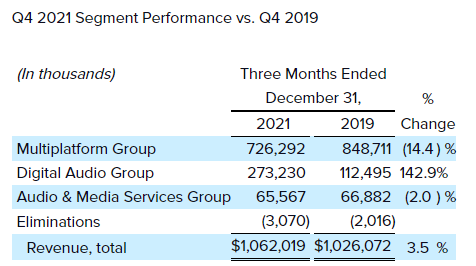

Total revenue for iHeartMedia in the final three months of 2021 increased by 3.5% from the same period of 2019, coming in at $1.062 billion, rising from $1.026 billion. It grew 14% compared to Q4 2020.

What drove this? Digital.

In short, Digital is on fire, and COO/CFO Rich Bressler shared details about the “consistently and stability” of iHeart’s assets during the quarter.

Sequential revenue improvement against 2019 was also noted by Bressler, with Q4 2021’s achievement truly noteworthy. Why? The biggest driver of revenue for iHeartMedia, its Multiplatform Group, was down 14.4% compared to 2019. Audio & Media Services Group revenue dipped by 2% when compared to two years ago in the non-pandemic impacted quarter.

Podcasting revenue was up 130% year-over-year, Bressler noted.

How is iHeartMedia’s net debt faring? It sat at $5.387 billion as 2021 came to a close.

Meanwhile, Q1 2022 revenue is expected to be up by 17%-19% year over year, Bressler said.

iHeartMedia Q4: By The Numbers

- Net income increased to $111.95 million from $2.9 million

- Adjusted EBITDA grew to $294.17 million from $265.9 million

- Free Cash Flow (including net proceeds from real estate sales) was statistically flat, at $53.05 million