Despite recent stories that P&G is backing off its ad spending on digital and coming home to traditional media, the momentum toward the big digital players continues. And, this is additional ammunition for radio executives who want more deregulation.

According to eMarketer, for the first time ever, digital ad spending will exceed traditional ad spending. But the predictions for the future are even worse. eMarketer projects that by 2023, only four years from now, digital will surpass two-thirds of total media spending.

A continent of radio executives, backed by The National Association of Broadcasters, wants the FCC to loosen its ownership rules, in part, to allow radio to become more competitive with the big digital players. They say this unregulated industry is taking ad money off the table in every local market across the country. On that point they are certainly correct. The big digital dog down the block, Amazon, continues to take share from just about everyone. eMarketer says Amazon’s ad business will grow by more than 50% this year and its share of the US digital ad market will swell to 8.8%. So it’s not only Facebook, Google, YouTube, Pandora and Spotify.

One of the reasons advertisers are flocking to Amazon, according to the online research firm, is data. eMarketer forecaster Monica Peart says, “Amazon offers a major benefit to advertisers, especially CPG and direct-to-consumer brands. The platform is rich with shoppers’ behavioral data for targeting and provides access to purchase data in real time. This type of access was once only available through the retail partner to share at their discretion. But with Amazon’s suite of sponsored ads, marketers have unprecedented access to the ‘shelves’ where consumers are shopping.”

Radio’s push for more deregulation is based on the fact that the rules they are governed by now are over 20 years old, a time when these digital companies did not even exist. And with a radio friendly FCC Chairman who has signaled changes need to be made, this may be radio’s best chance to have the rules loosened up.

This year total digital ad spending is expected to grow 19% to $129.34 billion. If that happens digital will make up 54.2% of estimated total US ad spending.

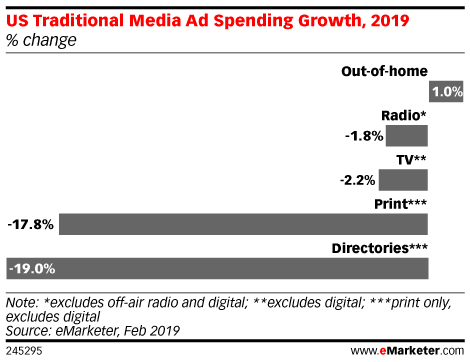

eMarketer projects that traditional ad spending’s share in the US will drop to 45.8% in 2019, from 51.4% last year with Yellow Pages, newspapers and magazines hit the hardest.

Radio is hoping to have the following changes made in order to compete with digital:

-In the top 75 Nielsen Audio markets, allow a single entity to own or control up to eight commercial FM stations, with no limit on AM ownership;

– — To promote new entry into broadcasting, an owner in these top 75 markets should be permitted to own up to two additional FM stations (for a total of 10 FMs) by participating in the FCC’s incubator program; and

– In Nielsen markets outside of the top 75 and in unrated markets, there should be no restrictions on the number of FM or AM stations a single entity may own or control.”

Note to Ron:

A Starbucks on every corner.

That’s the way to go.

Just ask Howard Schultz.

The difference, of course, is that Howard knew what he was doing. 🙂

One can’t help but remark. It’s the over-leveraged fat cats who are going bankrupt, rarely the smaller operators. Can anyone explain to me the logic of allowing such fat cats to hog ever more scarce spectrum? How is anybody benefited except maybe the fat cats?

What’s more, is there any proven example of digital causing a major market radio station to go bust? And if one might, then in the interest of the public and diversity, let the unfortunate victim sell for less to a newcomer with a better mouse trap. Deregulation mocks the very point and purpose of an incubator program. Let’s be rational. Avoid making FCC rules worse then they already are… sorely biased in favor of the wealthy few.