The following data is very important for radio managers and sellers to have. I’ve written about this research before and have been a huge fan of it since its inception. This is the first time this new data is being viewed, it just came out. The data on the charts below were taken from RealityMine’s USA TouchPoints. Their latest batch of data spans the second half of 2014 to January of 2016.

This data is as granular as it gets and enables us to set the record straight regarding radio and its position within the audio and media landscape. This is not anecdotal evidence but empirical data.

A reminder, when TouchPoints debuted, Jane Clark, the Managing Director of CIMM (the Coalition for Innovative Media Measurement) said, “We searched the globe to find the most consumer-centric platform approaches—TouchPoints is by far the most comprehensive, and provides the best way to link cross-media measurement and provide an understanding of media usage in context.” By the way, CIMM is comprised of many of the nation’s largest and most sophisticated advertisers and agencies. This is not minor league research. Discuss this with confidence and enthusiasm.

On a side note, we like the word “context” when discussing radio and believe it speaks to another radio advantage. Radio’s importance as an ad vehicle is far more than “reach” and “time spent listening.” Radio’s ability to reach consumers in different “contexts” — i.e. places other media can’t “go” — when they are “transitioning” from one life role to another, and the consequent enhanced moments of receptivity, is what makes radio a one-of-a-kind marketing vehicle.

One key methodological advantage of TouchPoints is that it is “single source” data, meaning that the entirety of each individual’s media usage is collected and then aggregated, hence the term “single source.” Nielsen’s ROAS (return-on-ad-spend) studies are also “single source” in that they determine spending behavior down to the individual consumer level. Same with TouchPoints.

There are 5,000 respondents in this study who downloaded an iPhone app that required them to answer five questions for each half hour throughout the day:

Where are you?

What are you doing?

Who are you with?

What media are you using?

How do you feel?

While we can “mine” TouchPoints for much more than media usage insights, this week we’ll focus on the topline “What media are you using” question.

Again, this data sets the record straight regarding the current audio and media landscape enabling us to expose our clients to what we’re exposed to, so they know what we know, believe what we believe, and think like we think, with the goal of getting them to embrace the medium the way we embrace it.

It might not be a bad idea to familiarize ourselves a bit with RealityMine and TouchPoints by checking out their site. Doing so might enable us to speak more effectively about the company and its TouchPoints product, giving the data added credibility.

In the chart below, 60% (59.8%) of all audio usage is to AM/FM programming. CD usage and personal music collection audio continues to decline. The latest Edison Share of Ear 2016 study also concluded the same thing.

Note, the iHeart/Pandora/Spotify/Songza/Slacker/iTunes data is not “streaming” in its entirety but usage of these six streaming services, which account for the vast majority of ad-supported streaming pureplay audio entertainment:

Even with Millennials, Radio programming’s share of audio usage across the country exceeds 50%:

AM/FM programming share of usage jumps back to over 60% of all A25-54 audio usage throughout the U.S:

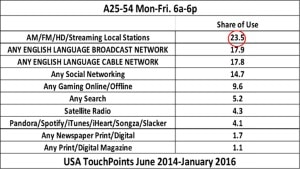

This slide sets the record straight regarding radio’s importance in the media landscape throughout 2/3 of the broadcast day Monday-Friday 6 a.m.-6 p.m., when most shopping occurs.

We’ve noticed the increased usage of social networking growth over the past several years of data, which is not a surprise. It does provide us with a good opportunity to take advantage of our personalitys’ social activity to complement any radio campaign we propose:

The data above are the tip of the TouchPoint iceberg, providing us with an opportunity to become our “own cause” to more effectively tell our own radio story.

The data above are the tip of the TouchPoint iceberg, providing us with an opportunity to become our “own cause” to more effectively tell our own radio story.

The following excerpts were taken from an Ad Age article this week that focused on the TV “upfronts” and the importance of “reach,” which is helpful, as radio is the #1 reach vehicle in the country.

They could prove useful when highlighting the importance of “reach” to an advertiser:

* “Consider that, if you wait to start marketing a luxury auto to people until they’re 40 years old and can afford to buy it, you’ve likely missed the opportunity to build their aspiration and affinity.”– Irwin Gottlieb CEO of GroupM (the industry’s largest media agency).

Comment: We liked Irwin’s comment as it speaks to the importance of broadcast and not hyper-targeting. With broadcast you not only reach your target demo, you reach beyond the target demo that’s necessary to begin “pre-selling” the next generation of buyers. It’s a powerful quote from an industry giant that can be used the next time one of the digital audio pureplays tout their ability to hyper-target only a specific demo.

* “Quite frankly, in television we usually don’t want to hit the same person over and over,” said Chris Geraci, president-national broadcast, OMD. “A lot of the messaging is directed to as many people as possible within a broad target audience, and reach remains one key benefit of TV.”

Comment: Overkill of messaging frequency at best leads to tune-out. At worst it leads to negative feelings.

* “Sometimes people make the mistake and think broad reach is bad. It’s not. Sometimes you can get the best of both worlds.” — Adam Harter, VP-cultural connections, PepsiCo.

Comment: And radio delivers it.

* Commercials on broadcast networks made up 17.3% of programming time in 2015, up from about 16.8% in 2012, according to Brian Wieser, analyst, Pivotal Research Group. On cable, they constituted 20.6% of programming time, up from 19.3%.

Comment: Clutter leads to lower productivity of each ad dollar.

Last week we highlighted the rationale for rotating in shorter-length commercials as a schedule progressed. A very well-respected media pro who read that blog wrote the following in response:

“Also, suggesting to a client that they consider running the shorter length might be a way to get an advertiser who’s reluctant to spend in radio to actually commit some dollars to it. It will be a smaller dollar commitment but will enable an AE to build a schedule that will be robust enough to still have an impact.”

We agree. Many TV campaigns generate tremendous audio equity that goes largely unused. Rotating in shorter-length radio commercials to supplement any TV campaign provides the following benefits:

– Gets our foot in the door

– Continuity of schedule = continued brand presence

– Memory maintenance = Radio is a terrific memory maintenance vehicle that economically refreshes memories

– Convergent reality = I heard it somewhere else so it is more likely “true”

– Complementary messaging = additional reasons to believe/purchase

And lastly, and probably most importantly, the ARF’s finding that adding radio to a TV-only campaign increases the ROI +20%!

Bob has already established credibility with me.

‘Tis a good thing that the (above) info reinforces the mostly-accepted premise that radio still enjoys an impressive reach and an, at least, semi-satisfactory ROI.

That poorly-constructed spots running on minimal budgets is still the sugar in the gas tank.

Indeed, the challenge is much more than educating advertisers on the power of radio. That “power” is, after all, only about potential, potential potentials. 🙂

Advertisers, particularly those who chirp, “I have already tried radio and it didn’t work.” require greater, pervasive and ongoing assurances. Those are not forthcoming.

Not up to your usual level, Bob. Way too nerdy and hair-splitting. Plus the end revives the old RAB chestnut about radio (in a media mix) helping people remember a TV commercial. As tempting as that sounds, Bob, it never caused anyone to sell radio. Instead, it diminished radio as nothing more than an “ad–on” as an afterthought medium. Not true at all. Radio is a primary medium. Not enough radio people believe that.