(By Bob McCurdy) Earlier this week I was working on a deck to present to a large home furnishing company that has built its business largely with TV. My contention will be that, as good as business might be, there is a way to make it even better.

My discussion with them will focus on a few basic, widely accepted marketing principles, market specific TV and radio data, and some channel planning “science,” that will suggest how they might generate even more bang for their advertising dollar.

I accessed Media Monitors and ascertained that this advertiser had aired over 21,000 TV commercials since the beginning of the year. This translates to approximately 550 TV commercials/week, or about 78 per day. During this same period, this advertiser aired 300 radio commercials or 70 TV commercials for every one radio commercial. A startling disparity.

The marketing principles discussed will center on the following:

– “Silo-investing” in any media channel leads to diminishing returns.

– No single channel strategy can provide effective coverage in any market.

– Each medium has its strengths and limitations, which is why a mix of media will out-perform the use of any single medium.

– No matter how much more effective any medium might be initially, there does come a point when the next ad dollar would be more productive spent in another medium.

– The same number of exposures in multiple media is more effective than the same number of exposures in a single medium. Multiple media have a greater sum effect. When it comes to media mixes, 1+1 does equal 3.

– Each medium has its heavy and light users. Attempting to reach all users of any medium leads to wasted dollars. In this market, the heaviest TV viewer will be exposed to 30 times more of this retailer’s commercial than the lightest TV viewer.

– When similar messaging is scheduled across multiple media, receptivity to the messaging increases. Radio advertising “primes” TV advertising and vice versa.

– Radio can communicate additional reasons for the consumer to purchase from this retailer in addition to “priming” the TV messaging.

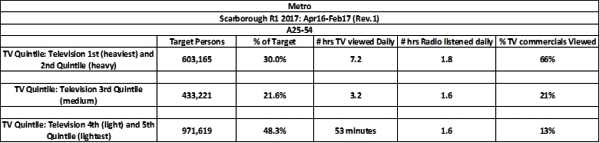

The “data” part of the discussion will highlight the disparity of viewing between the markets heaviest and lightest TV viewers. The graph below supports the logic of adding radio to their current TV campaign, as only 30% of Boston’s A25-54s view 66% of the market’s TV commercials, while close to half (48.3%) view only 13% all TV commercials. Additionally, these light and lightest TV viewers watch TV less than an hour daily (53 minutes) but listen to radio almost twice as much (1.6 hours/day).Can any retailer afford to ineffectively reach half of its target audience?

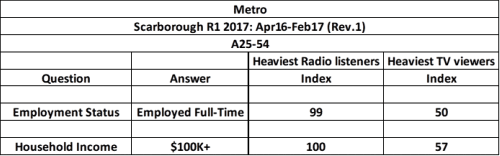

Next, I will highlight the profound qualitative difference between the heaviest TV viewers and heaviest radio listeners; with the heaviest radio listeners being twice as likely to be employed full-time and reside in a home with a HHI of $100,000+.

Which consumer is the better home-furnishing prospect?

I will end the discussion by focusing on some “science,” reviewing the results from Nielsen’s Commspoint. Commspoint is an unbiased planning tool to which most of the country’s major advertising agencies subscribe.

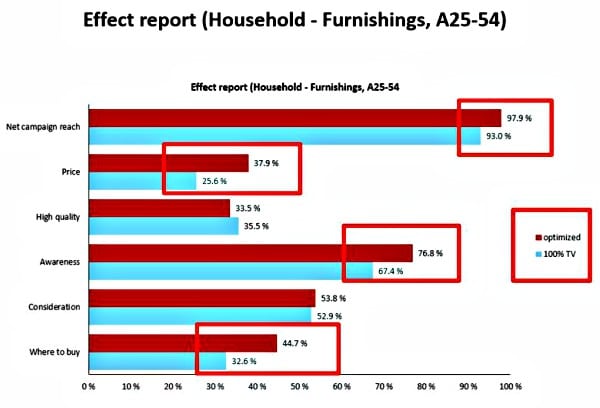

Based upon this market’s TV and radio CPPs, and the tasks and tactics chosen, Commspoint “optimized” this client’s current budget recommending that 62% of dollars be allocated to TV, with 38% allocated to radio. The chart below compares the results of the “optimized” campaign (TV and radio) versus the current budget allocation of 100% TV.

The optimized allocation generated:

– Slightly better overall reach.

– Was 48% more effective in communicating “pricing” messaging.

– Only slightly less effective in communicating “high quality” messaging.

– +14% more effective in generating “awareness.”

– Slightly more effective in generating “consideration.”

– +37% more effective in communicating crucial “where to buy/shop” messaging.

I realize this is only the beginning of the “why radio” discussion with this client, but it’s a good starting point in that my deck will include accepted marketing tenets, localized media data, and channel planning science.

I like my chances.

Bob McCurdy is The Vice President of Sales for The Beasley Media Group and can be reached at [email protected]

Sounds airtight. Love to hear how it goes.

Excellent strategy. Good luck and very interested in hearing your results.