According to SNL Kagan’s latest annual outlook, radio revenue will decline 0.3% in 2017 to $17.65 billion, down from $17.7 billion in 2016. Kagan says increases in digital and off-air sales will help offset declines in national and local advertising. And even with the return of political in 2018, the firm is only projecting an increase of 1.3% for radio, to $17.89 billion. Here’s how Kagan breaks down the numbers for 2017 and beyond…

Kagan says national revenue is expected to decline 3.0% in 2017, due to political comps from 2016. Local revenue will decline 2.0% in 2017 based on a somewhat strong second quarter and auto dealers looking to move inventory. Kagan also says local will benefit from improving ad rates, with lower average-unit-rate political spots being displaced by higher-priced core advertising. Digital will grow by 7.0% in 2017 to $1.18 billion from $1.10 billion in 2016, growing to $1.25 billion in 2018. Off-air revenue will increase by 8.5% in 2017 to $2.41 billion and 6.0% in 2018 to $2.55 billion.

By comparison, BIA Kelsey is projecting 2017 over-the-air revenue for radio at $14.2 billion in 2017 (+0.1%) and $14.3 billion in 2018 (+0.9%), and digital revenue of $1.3 billion (+9.7%) in 2017 and $1.43 billion in 2018 (+10.3%).

Kagan says programmatic, digital, and live events will help the industry grow over the next five years. “Radio’s lower ad cost, local audience, and relatively high return on investment compared to other media will also continue to generate business for station owners.”

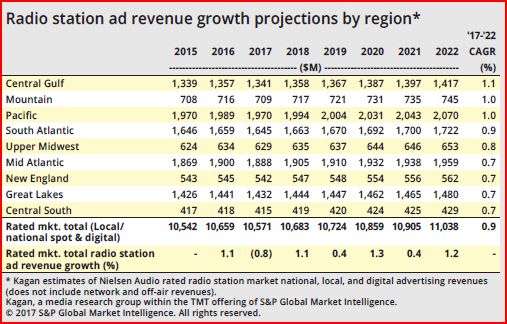

Between 2017 and 2022, Kagan is forecasting radio station local and national spot ad revenues (including digital) in rated radio markets to increase at a compound annual rate of 0.9%, with non-rated markets declining at a negative CAGR of 0.9%. “Total radio revenue, including national and local spot, digital, off-air, and network revenue, is expected to grow at a five-year CAGR of 1.1% from an estimated $17.65 billion in 2017, reaching $18.60 billion by the end of 2022.”