(By Bob McCurdy) The radio industry’s leading headline of late has been its 93% reach metric. Wisely, we are no longer positioning ourselves as the “frequency” medium in such a fragmented, reach-parched media landscape for good reason, as companies typically grow by getting more customers, and getting more customers requires reaching more people.

Is it possible, though, that the manner in which radio is bought and sold limits “reach,” thus capping campaign results?

Programmers have long been familiar with radio’s heaviest (P1), heavy (P2), medium (P3), light/lightest (P4+) listeners, but maybe it’s time that we pay more attention to these listening quartiles and the role they play in campaign reach.

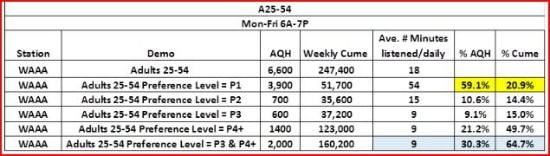

Let’s dissect the Nielsen AQH/cume estimates for a top-ranked A25-54 station in a PPM market, WAAA.

WAAA’s January/February/March 2017 M-Fri. 6A-7P AQH was 6,600 with a weekly cume of 247,400. The 247,400 is an enticing “box car” number for any advertiser, but what are the chances of reaching them?

Per the chart below, we see that 59.1% of WAAA’s total listening comes from only 20.9% of its listeners, while 64.7% of its listeners account for only 30.3% of its listening, tuning in for an average of only nine minutes/day.

This type of audience stratification is not unusual for any radio or TV station, medium or product (Google: Pareto’s Law).

So what are the chances of reaching a listener who tunes in only nine minutes/day in this M-Fri. 6A-7P daypart? Approximately 100 to 1. Not ideal odds for maximizing reach.

Understanding how the different listening quartiles contribute to Nielsen’s estimates enables us to create campaigns that maximize reach.

Placing a heavy spot load on stations such as WAAA generates excessive frequency against a small percentage of station listenership, limiting reach, and quite possibly, payback. Being familiar with this phenomenon is particularly important when scheduling call-to-action, time-sensitive campaigns, which depend upon generating reach quickly.

A better “reach” scheduling option would be to buy deeper, putting fewer commercials on more stations, effectively covering each station’s core P1 listeners. Once accomplished, add the next station to reach its P1 core listeners, the next station, etc., ultimately buying as deeply as the budget allows.

In this example, WAAA’s P1 core listeners can be effectively reached with a 13x-15x schedule, computed by “buying” WAAA to its P1 turnover (51,700/3,900). Buying to “turnover” typically reaches 60% of a station’s audience, in this case WAAA’s P1s. Reach more than 60% of any station’s audience and frequency begins building at the expense of reach.

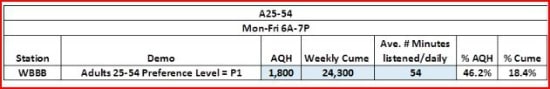

While WBBB’s published January/February/March 2017 M-Fr. 6A-7P A25-54 AQH is 40% smaller than WAAA’s 6,600 vs 3,900, station WBBB’s P1 core listening audience is larger than any other of WAAA’s listening quartiles, excluding its P1 core.

So once WAAA’s P1 core has been effectively covered, the reach-centric tactic would be to add WBBB to the buy instead of continuing to air additional commercials on WAAA. Note also that WBBB’s P1 core listener also spends 6x as much time daily with the station (54 minutes vs WAAA’s P3/P4’s nine minutes) making it easier to reach them than any of the other three WAAA quartiles.

Takeaways:

Heavier station spot loads reach fewer listeners than daypart cume might lead us to believe.

It takes big reach to make big sales, so it often makes sense to reach as many different consumers as possible at once, before the money runs out (buying deeper).

“Over-buying” a radio station means paying for excessive frequency against a station’s core P1 listeners, which limits reach.

Fewer commercials aired on more stations increases “reach” and get us closer to radio’s maximum reach potential for one reason: each additional station added to a campaign duplicates less with the stations on the buy, than these stations duplicate with themselves.

Would any advertiser who wants to get the most bang for their ad dollar ever purposely target the light/lightest listeners of any station or ad vehicle? Not likely.

There comes a point when the next ad dollar, from a reach standpoint, would be more productively spent on another station and in call-to-action, time-sensitive campaigns, it just might be when any station’s P1 audience has been bought to “turnover.”

Something to keep in mind when attempting to maximize client reach and payback.

Bob McCurdy is The Vice President of Sales for The Beasley Media Group and can be reached at [email protected]