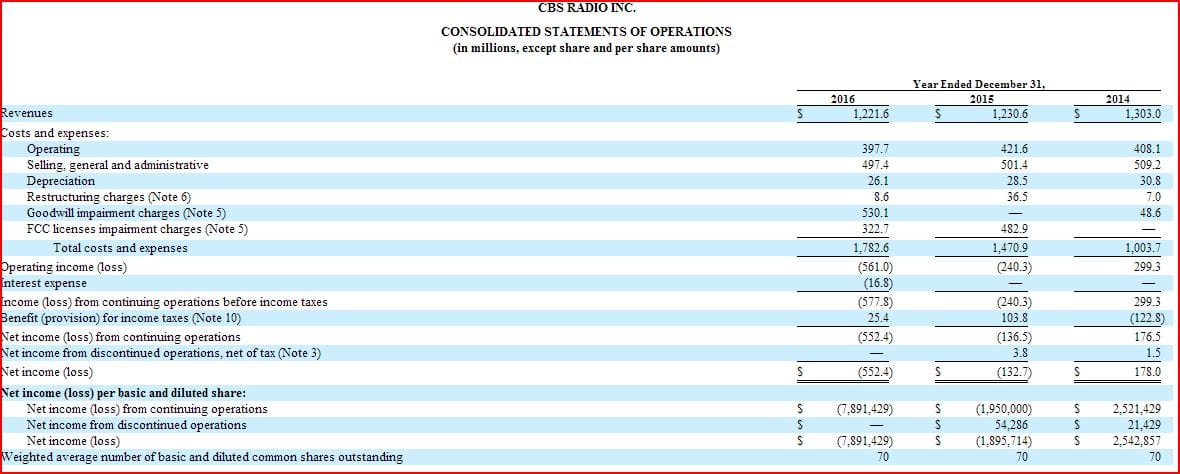

That’s according to a new document filed with the SEC by Entercom, showing CBS’ statement of consolidated operations, as it moves closer to merging with CBS radio and taking over its 117 stations in 26 markets.

The document shows that CBS Radio lost $552.4 million on $1.2 billion in revenue in 2016, the company lost $132.7 million on $1.23 billion in 2015 and it made $178 million on $1.3 billion in 2014. Costs and expenses at the company went from $1 billion in 2014 to $1.47 billion in 2015 to $1.8 billion in 2016. Entercom CEO David Field has said there will be $25 million in synergies when the companies merge and the revenue will be approximately $1.7 billion.

Wells Fargo analyst Marci Ryvicker recently stated that “CBS Radio’s underperformance vs. the industry and Entercom seems to have resulted from poor management vs. station portfolio or brand.” And she believes Entercom can turn that around within 12 months.

A major expense for both 2015 ($322.7 million) and 2016 ($482.9 million) were impairment charges on FCC licenses. If you’ve never heard of that, here’s exactly what that means, straight from the SEC filing document…

For 2016, the Company performed a quantitative impairment test of FCC licenses in all of its markets. This impairment test compares the estimated fair value of the FCC licenses by geographic market with their respective carrying values. The estimated fair value of each FCC license is computed using the Greenfield Discounted Cash Flow Method (“Greenfield Method”), which attempts to isolate the income that is attributable to the license alone. The Greenfield Method is based upon modeling a hypothetical start-up station and building it up to a normalized operation that, by design, lacks inherent goodwill and whose other assets have essentially been added as part of the build-up process. The Greenfield Method adds the present value of the estimated annual cash flows of the start-up station over a projection period to the residual value at the end of the projection period. The annual cash flows over the projection period include assumptions for overall advertising revenues in the relevant geographic market, the start-up station’s operating costs and capital expenditures, and a three-year build-up period for the start-up station to reach a normalized state of operations, which reflects the point at which it achieves an average market share. The overall market advertising revenue in the subject market is estimated based on recent industry projections. Operating costs and capital expenditures are estimated based on both industry and internal data. The residual value is calculated using a perpetual nominal growth rate, which is based on projected long-range inflation in the U.S. and long-term industry projections and for 2016 was 1.0% for each radio station. The discount rate is determined based on the average of the weighted average cost of capital of comparable entities and for 2016 was 8.50% for each radio station. For 2016, the Company concluded that the estimated fair values of the FCC licenses in 23 radio markets were lower than their respective carrying values. Accordingly, the Company recognized a pretax noncash impairment charge of $322.7 million related to FCC licenses in these markets. For the remaining two radio markets, the Company concluded that the estimated fair values of FCC licenses in each market exceeded their respective carrying values and therefore no impairment charge was necessary.

For 2015, the Company recognized a pretax noncash impairment charge of $482.9 million to reduce the carrying value of FCC licenses in 18 markets to their fair value. The charge included $39.6 million to reduce the book value of KFWB(AM) in Los Angeles to its fair value. KFWB(AM) was classified as held for sale at December 31, 2015.

Read the latest Entercom filing about the merger HERE