While marketers continue to funnel major money into ad-supported audio streaming, they could be much better served by radio. Media planning, as it currently stands, could use some recalibration as AM/FM continues to significantly outperform advertiser perceptions.

The latest findings from Edison Research’s “Share of Ear” study, which surveys 4,000 Americans each year to analyze their audio consumption, have shed new light on the discrepancies between advertiser perceptions and actual audience engagement in the ad-supported audio sector.

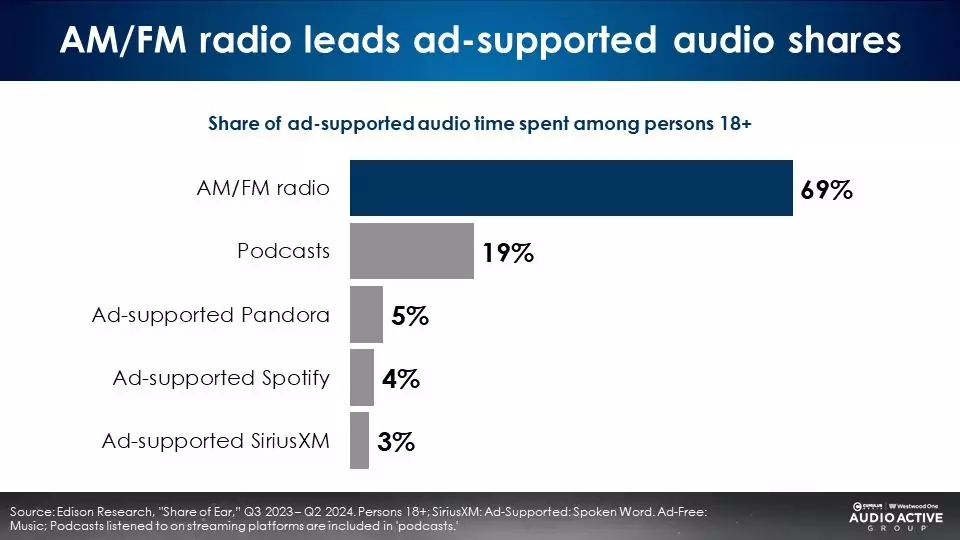

So how relevant is radio? Edison’s Q2 2024 report shows that over-the-air radio holds more than double share of ad-supported audio than the next four biggest sources combined.

AM/FM’s in-car share of ad-supported audio time is even more commanding, at an overwhelming 86%.

While there’s been a decline in the daily reach of over-the-air radio, dropping from 69% in Q2 2017 to 59% in Q2 2024, this has been slightly offset by modest growth in streaming of AM/FM content, up from 8% to 11%. Podcast daily reach has seen a significant increase, tripling from 7% over the past seven years, all while the reach of ad-supported Pandora halved, from 12% to 6%, and ad-supported Spotify a 1% gain, from 4% to 5%.

Even given radio’s performance, marketers aren’t aware of the medium’s fair share.

In August, Advertiser Perceptions conducted a survey with 303 media agencies and advertisers who have control over media budgets. They were tasked with estimating the audience shares for Spotify, Pandora, and AM/FM. The results, when compared to Edison’s research, revealed significant discrepancies between perceived and actual audience sizes.

Spotify’s perceived audience share was reported at 25%, significantly higher than its actual share of 4%. Pandora was believed to hold an 18% share, yet the actual figure was only 5%. Conversely, radio was under-estimated by the respondents, who perceived its share at 27%, while the actual share was much larger at 69%.

This misalignment suggests a pervasive bias among advertisers towards newer, digital-first media platforms, often at the expense of established mediums like radio that continue to demonstrate significant reach and engagement. Knowing this, advertisers and agencies could be wise reconsider where and how they allocate their budgets.

As FBR Capital Markets analyst Barton Crockett noted in 2016, “Pandora pioneered something really interesting, really special with their free ad-based streaming music service … [but now] the early adopters are moving to on-demand, & mainstream America is still in love with AM/FM radio.”

More details, particularly on the fall of Pandora, can be found in this week’s Cumulus Media/Westwood One Audio Active Group blog.