(By Bob McCurdy) No business competes in a vacuum and no business is immune to the effects of a competitor’s advertising. It’s important for those advertisers with a limited advertising budget to choose their ad vehicles with care or risk having their messaging being drowned-out by the competition.

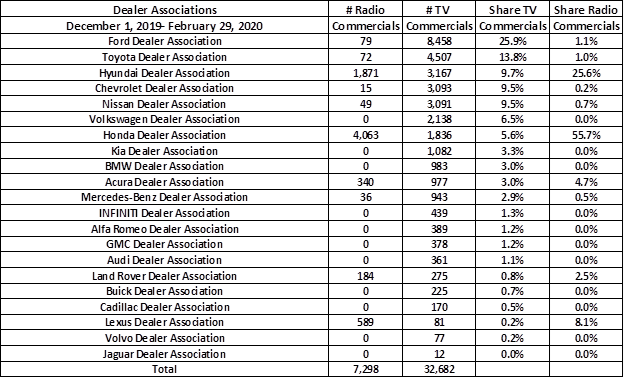

Smart advertisers closely monitor the ad environment in which they compete and adjust their ad spend and choice of ad vehicles based upon competitive activity. Besides invisibility, “misattribution” is another reason to do so. It’s easy to envision how a viewer seeing a Kia commercial might misattribute it to Ford due to Ford airing eight times as many TV commercials as Kia (see data chart below).

So how does the advertiser with a limited ad budget avoid becoming invisible? By advertising where the big guys aren’t.

Let’s look at an auto dealer association example in a top 25 market. The Media Monitors data is for the three-month period of 12/1/19-2/29/20. Pulling this data for the automotive vertical not only provides us with another reason to engage auto dealerships or dealer associations with helpful information, as it is data to which they likely don’t have access, but it also provides a sound rationale for them to consider the use of, or “heavying up” in, radio.

The top five associations, in terms of number of TV commercials aired, accounted for seven out of 10 dealer association commercials in this three-month period, with Ford alone accounting for 25.9%. Of these top five, only Hyundai used radio to any meaningful degree. Conversely, 14 dealer associations accounted for less than 20% of all dealer association TV commercials aired. What kind of share-of-voice did any of these associations achieve? Additionally, due to misattribution, they were likely unknowingly bolstering the effectiveness of the larger associations advertising.

Let’s put this data into perspective:

– For every Mercedes-Benz Association TV commercial that aired, 35 other auto association commercials aired.

– For every Audi Association TV commercial that aired, 91 other auto association commercials aired.

– For every Buick Association TV commercial that aired, 145 other auto association commercials aired.

– For every Cadillac Association TV commercial that aired, 192 other auto association commercials aired.

You get the picture. Their TV share-of-voice was zilch.

Land Rover would likely have gotten a greater payback if they took the budget for their 275 TV commercials and allocated it to radio, bumping up their share of radio spend to the 7% range instead of a 0.8% share of association TV commercials.

It would certainly seem that a number of these dealer associations, instead of having their share-of-voice on TV being one/two percent or less, could generate more impact by utilizing radio instead of being virtually invisible on TV. It also appears as if Ford could have allocated more budget to radio to neutralize Honda and still easily have maintained their dominant share-of-voice on TV.

Media Monitor data enables us to walk into a dealership or agency considerably better prepared to discuss “Why radio?” From the chart above, it appears there are a number of associations getting out-shouted that needn’t be, and it would be my guess that this chart would not differ much by market.