(By Bob McCurdy) The RealityMine 2016.1 USA TouchPoint data has just come out and it again confirms AM/FM’s audio dominance. The data is a combination of fieldwork conducted March-November 2015 and January-April 2016. We’ve written about USA TouchPoint research previously, as we’ve been fans of it since its inception due to its single-source, e-diary methodology.

The following charts powerfully illustrate AM/FM radio’s continued importance within today’s audio universe and should be reviewed with each of our clients as it reflects the audio landscape as it exists today. Having a clear understanding of AM/FM’s continued popularity will enable them to make better, more informed, and effective marketing decisions. A win-win for all.

Interestingly, this data, while considerably more granular (5,000 respondents participating for 10 days) than several of the recent Edison “Share of Ear” studies, shows a similar story: that AM/FM radio, by a long shot, remains the preferred audio option of American consumers. To more effectively explain/discuss these findings, it might be a good idea to take a few minutes to check out RealityMine’s website. They are a respected, blue-chip international research firm: https://www.realitymine.com/.

This week we’ll focus on topline audio listening behaviors, but in subsequent weeks we’ll dig deeper into the data analyzing AM/FM radio’s place within the entire media ecosystem. These slides just begin to scratch the surface of the kind of rich insights that can be mined from this USA TouchPoints data.

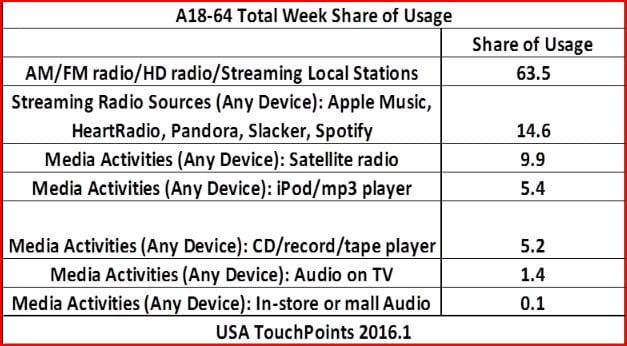

Takeaway #1: AM/FM content accounts for almost two-thirds (63.5%) of all audio consumed on the following audio channels:

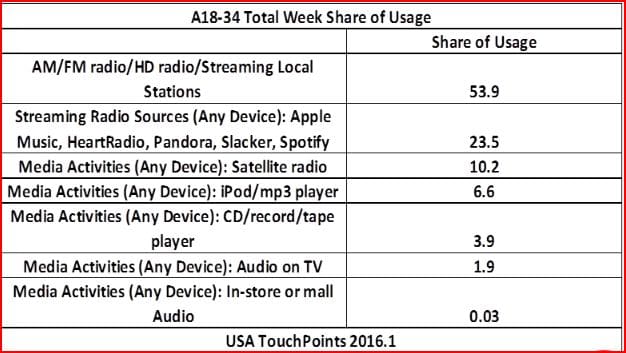

Takeaway #2: While AM/FM content’s share is slightly lower with 18-34 adults, it still remains their dominant audio option:

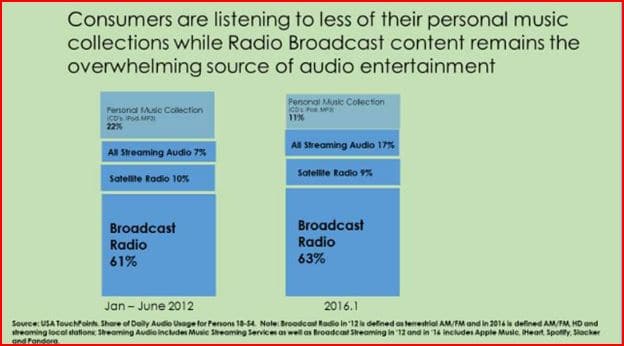

Takeaway #3: This next A18-54 slide is particularly interesting in that it lends support to our long-held contention that the audio option that would be most negatively impacted by streaming audio’s growth would be the CD, iPod and MP3- their personal music collection. And while there are slightly different audio classifications between 2012 and 2016 (Broadcast Radio in 2012 included only AM/FM Radio, in 2016 it includes AM/FM, HD and listening to local Radio station streams), as well as minor methodological refinements over the years, the takeaway is still directionally quite strong and clear: Streaming audio’s listening gains are coming primarily at the expense of the iPod, MP3 and CD and that AM/FM programming remains hugely popular and largely steady Takeaway #4: Next, we wanted to get a better feel for the audio habits of the Pandora listener and what we found was that the Pandora listener spends quite a bit of time with AM/FM content, spending almost twice as much time with AM/FM content as they do with Pandora. The results were similar when we combined Pandora with Spotify, iHeart, Slacker and the Apple Music listener, indicating those that “stream” actually spend more time with AM/FM programming than they do with their streaming option of choice. So clearly it’s not a case of “or” but “and” with audio streamers, meaning advertisers can deliver their commercial messaging to them via Broadcast Radio.

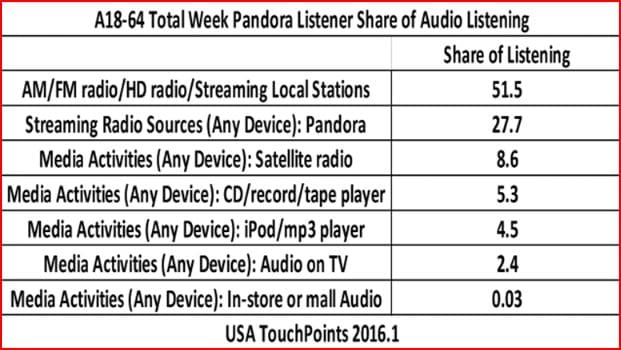

Takeaway #4: Next, we wanted to get a better feel for the audio habits of the Pandora listener and what we found was that the Pandora listener spends quite a bit of time with AM/FM content, spending almost twice as much time with AM/FM content as they do with Pandora. The results were similar when we combined Pandora with Spotify, iHeart, Slacker and the Apple Music listener, indicating those that “stream” actually spend more time with AM/FM programming than they do with their streaming option of choice. So clearly it’s not a case of “or” but “and” with audio streamers, meaning advertisers can deliver their commercial messaging to them via Broadcast Radio.