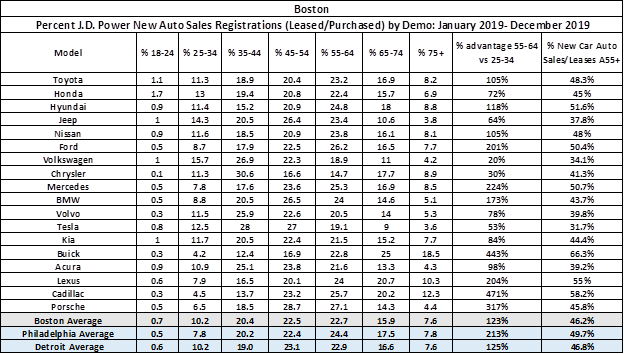

(By Bob McCurdy) The data for the chart below comes from Nielsen’s sales mapping tool, Rhiza, which utilizes Polk automotive data, which provides auto buyer demographics. This means it summarizes who actually purchased/leased new automobiles, not who one thinks purchased/leased them.

It would be safe to conclude that, give or take a few percentage points, the data would be similar in most markets. This opinion is based upon the similarity of three markets analyzed: Boston, Detroit, and Philadelphia.

Baby boomers were born between the years 1946-1964 and range between 56 and 74 years of age, which means they fall outside the 25-54 demo, and as such are regularly deemed to be of little importance by marketers. This in spite of “seniors” having never been healthier or wealthier, and the plethora of stats that support their massive spend across all product categories.

How important are boomers to U.S. commerce? According to U.S. News & World Report, boomers control 70% of the country’s disposable income, spending $3.2 trillion a year, and they buy products that might even surprise some. Harley-Davidson Chief Marketing Officer Mark Hans-Richer has said, “We sell new bikes to guys in their 80s all the time.” Boomers are active, and many think and act as if they are 20% younger, according to a Michigan State study.

Robert Passikoff, President of Brand Keys Inc., told the New York Times that, “While the millennials are sharing stuff, boomers are buying stuff. If you are a brand, you are in business to make money, and a tweet or share or laugh online doesn’t translate into actual bottom-line dollars. Boomers are an audience that’s worth pursuing in virtually every category.” Yet a study by the National Venture Capital Association, Ernst & Young, and AARP found ad spend targeting this group is minuscule, concluding, “Baby boomers are targeted by just 5-10 percent of marketing.”

Nielsen has projected that boomers spend almost $90 billion a year on cars, so let’s compare boomer new car purchases/leases with other demos using Rhiza. Millennials and Generation Z may be the future, but the boomers have the cash, as well as the need and desire to spend it now.

Some key takeaways from the following data:

– Adults 75+ purchased 11x as many new cars as those aged 18-24.

– For every 100 new cars that the 25-34 adult purchases/leases, the 75+ adult purchases/leases 75.

– The 55-64 adult purchased/leased more new automobiles than any other demo.

– On average the 55-64 adult accounted for +123% more new car purchases/leases than the 25-34 adult.

– 55+ adults can’t be ignored when it comes to moving metal off dealer lots, accounting for virtually half (46.2%) of all new car purchases/leases in Boston in 2019, 49.7% in Philadelphia, and 46.8% in Detroit.

– The 65-74 adult accounted for 56% more new auto purchases/leases than the 25-34 adult.

– The percentage of new car purchases/leases by demo are largely consistent across the other two markets analyzed, Philadelphia and Detroit.

If you handle an auto dealership, it will be well worth a minute or two reviewing the purchases/leases by OEM — they are remarkably similar regardless of make. The two outliers appear to be Chrysler (this was consistent across all three markets) and Tesla.

The importance of the 55-74 year old adult can’t be ignored.

Target the A25-54 demo to reach the car buyer and you just might execute an efficient buy ineffectively. Take better aim by including the A55-64 demo and you just might hit a bullseye. The highways in America are clearly grayer than the reverence bestowed upon the 25-54 demo suggests.

So what are boomers good for besides lending their children money, babysitting the grandkids, and frequenting CVS and Walgreens? It appears to be buying or leasing new automobiles — and a lot of them.

The 25-54 demo is an incredibly unreliable proxy to target new car buyers. Many dealerships are overlooking a huge opportunity by not marketing to boomers because of what appears be a preference to pursue Millennials and Generation X.

The breakout above should serve as an impetus for all involved in the marketing of automobiles and selling of media to reevaluate what we all think we know.

Kepital and fuhst clahss information, Bob.

Imagine the impact that could be had on the 55+ demo if commercials were prepared that would be appealing to this otherwise jaded, cynical and already saturated-with-radio-drek group of INDIVIDUALS.

Radio, populated by (allegedly) astute and otherwise clever marketers, fails on two levels.

It fails to target the demographic in the first place and, if and when it does, it fires out the weakest of standard-issue skanky spots that aren’t purposely-designed to do anything for anybody, particularly this demographic – other than to keep the writing and production time and costs down in the basement.