(By Bob McCurdy) This past week I had a conversation with a General Manager of an Audi dealership, suggesting to him that while his primary target was adults 25-54, he shouldn’t be content reaching only adults 25-54, as that was likely a short- and long-term recipe for declining sales.

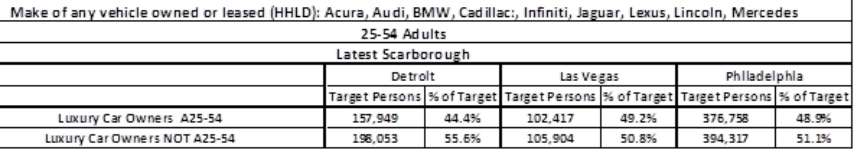

Here’s why. The smart operator understands that adults 25-54 while “worth more,” are not the only individuals who purchase automobiles. How much more adults 25-54 are actually worth depends on their purchase density or index, however it’s not unusual for those not in the target demo to actually account for more total purchases than those in the target demo due to their sheer numbers. This is true when it comes to luxury automobiles and just about any other product.

Some targeting is desirable. It’s an astute marketer’s way of providing some focus to the reach that’s necessary to maximize revenue. While the Internet can identify and deliver an ad to only adults 25-54, that precision limits the number of current customers and prospective customers who will be exposed to the messaging/offer. The reality is that the demos surrounding the adult 25-54 demographic happen to only bring down the CPM but purchase the product as well.

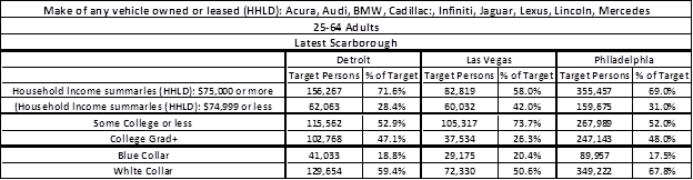

The default demo of choice for the past 40+ years has been adults 25-54 and the luxury car OEMs have largely marched in lock-step. More often than not, the typical luxury auto dealership targets adults 25-54 (occasionally adults 25-64), white-collar workers with a $75K+ HHI (sometimes $100K+). Is laser-targeting this demographic a good thing? Per below, it would not seem so.

Fifty-two and a half percent of the owners of these luxury automobiles in these three markets fall outside the 25-54 demo. Can any auto dealership, luxury or otherwise, afford to not speak to half of all current luxury automobile owners? Luxury car owners don’t only own expensive cars.

The following chart includes the 55-64 demo (A25-64), a demo whose importance is grossly under-appreciated.

Is a high income a prerequisite for luxury automobile ownership? To some degree yes, but across these three geographically diverse markets (no reason to believe they are not reflective of other markets) one-third of the luxury nameplates were owned by individuals with a household income less than $75,000.

Are luxury automobile owners college graduates? Not always. Sixty percent of them in these three markets did not graduate college.

White-collar workers are more likely to own one of these luxury nameplates but one out of five are owned by blue-collar workers and that amounts to tens of thousands of owners. Blue-collar workers, it seems, control a lot of green.

While common sense suggests that high-income, white collar, college educated households buy “luxury” brands, while lower income, blue collar households buy the “value” nameplates, maybe a little “uncommon” sense is required to maximize sales.

There are times when consumers spend extravagantly and at other times frugally, regardless of household income or education. It often boils down to what products/services are valued and the “trade-offs” made to own them. Some might settle for a smaller apartment to afford a more expensive car or decide to repair their current set of wheels to fund a vacation. High-income shoppers shop Wal-Mart just as lower-income shoppers frequent Saks Fifth Avenue. It’s these “trade-off” decisions that result in luxury goods not being the exclusive domain of high-income, white-collar, and college-educated households.

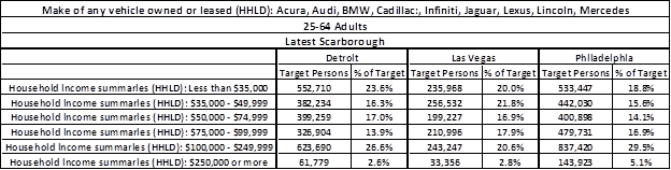

Would it surprise anyone that there are more individuals who own one of these expensive nameplates with a HHI of less than $50,000 than over $100,000? It appears to be the case:

This is why it makes sound business sense to market inclusively, which requires reach/broadcast. There are a number of important takeaways from these stats, and while the luxury automotive category was chosen for this comparison, other categories are not dissimilar:

– Reach all current consumers of a brand’s/product’s service category — they are all potential customers.

– Examine all marketing options in terms of their ability to cost-effectively reach as many current and potential customers as possible.

– Avoid narrow definitions of the brand’s target market that are out-of-sync with who actually purchases the brand.

– Targeting too narrowly can actually negatively impact sales.

– Demographics are incredibly unreliable proxies for product consumption.

– It is always good to reevaluate what we “think” we know.

The final takeaway is that there’s extraordinary competitive opportunities for those advertisers who understand who actually purchases their product/service and make marketing decisions and media allocations based upon that knowledge.

Bob McCurdy is Vice President of Sales for the Beasley Media Group and can be reached at [email protected].

And, oh yeah.

What Dick sez. 🙂

McCurdy Still our Hero after all these Years!

I dunno, Bob.

Perhaps the learning/understanding/application curve is a little radical on this one.

Maybe just stick with the ol’ “Pulse and a Pay check” Strategy. 🙂