(By Bob McCurdy) In a recent issue of Admap there was a thought-provoking article written by two high-level MEC execs that focused on over 250,000 individual purchase journeys across 36 categories. The two authors identified four stages of the purchase journey:

– The “passive” stage, when people are not consciously thinking about a purchase.

– The “trigger” stage, when a specific need or want surfaces.

– The “active” stage, when the consumer begins thinking about a potential purchase.

– Finally, the purchase itself.

The authors posit that there are several reasons why it has become increasingly challenging to influence decisions in the “active” stage – a stage that advertisers are increasingly focusing on due to available, quantifiable digital metrics.

First, they contend that few people buy a brand that they were not considering purchasing when they initially “entered” the market.

Second, the size of consumers’ “consideration sets” (the number of products/services considered for purchase) across the categories studied have remained largely steady, as the number of “choices” have grown exponentially.

Third, the cost of media targeting consumers in the active stage has increased significantly over the years.

These three factors lead the authors to encourage marketers not to lose sight of the importance of reaching the consumer when they are in the “passive” and “trigger” stage, to ensure a product/service is even “considered” for purchase.

The authors observed, “Rather than simply push the product, brands can actually help customers meet their goals by creating communications and utility that are useful for their needs before they come to market.”

This plays into three core radio strengths: the ability to generate massive “awareness” and, once aware, get the product/service “considered” (consideration). After all a product/service can’t be considered if they are not aware of it and they can’t purchase it if they don’t consider it. Radio also enables an advertiser to communicate how a particular product/service fulfills a certain need/desire.

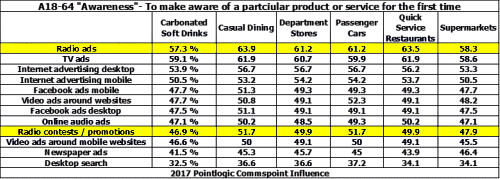

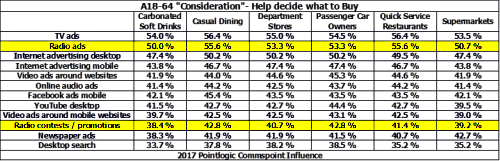

Same as last week, the following data comes from Nielsen’s Commspoint channel planning tool. The percentages below reflect a “relative rank” due to the fusion of consumer responses to Commspoint’s 2017 U.S. consumer survey, each medium’s pricing as well as each medium’s reach potential.

Note in the chart below that when it comes to overall effectiveness in generating “awareness,” that radio comes out on top in these six important product verticals. Also, be sure to take note of how favorably radio promotions perform when compared to some of the newer media channels. These on-air “promotions” are often requested and provided as value added. When we do so, we are handing an advertiser a top “awareness” and “consideration” vehicle as a freebie. On-air radio promotions clearly provide tremendous media value.

When it comes to generating “consideration,” buck for buck, radio is the virtual equal of TV, outperforming the newer media options while radio promotions remain as effective as many newer media options.

The much-respected consulting firm McKinsey has also been studying the consumer purchase journey. They too, reinforced not only the importance of squeezing onto a consumer’s consideration set, but also noted that once considered, a marketer’s challenge is to protect its place within that consideration set, fending off competitors looking to squeeze their way onto it.

This also plays into another key radio benefit- cost efficiency. While radio is the perfect medium to generate both “awareness” and “consideration,” it also enables an advertiser to maintain a share-of-voice advantage, which is often critically important in rebuffing competitive ad assaults designed to reshape a consumer’s consideration set.

Bob McCurdy is The Vice President of Sales for The Beasley Media Group and can be reached at [email protected]