(by Bob McCurdy) We met with the President of a tier 2 auto association this week. As most of us know, there are three tiers of automotive advertising. Tier 1’s message is to convince the consumer to “buy a Ford”. Tier 2’s message is to convince the consumer to “buy a Ford now”. Tier 3’s messaging is focused on getting the consumer to “buy a Ford here”. This particular OEM’s tier 2 Radio dollars had largely dried up, with the funds directed toward TV. Our goal for this first meeting was simple, to get an audience with the entire dealership group to present a “why Radio” rationale.

We prepared only two slides. But we also took a few minutes to review the past several months of Automotive News’, as we wanted current auto industry developments to be top-of-mind, i.e. the increased implementation of “stair stepping” (which pays dealers escalating bonuses if they hit progressively higher sales targets, but pay nothing if sales fall short), the likely slowdown in overall vehicle sales, the increased popularity of the lease (30% of all auto transactions) , the sedan “recession” and the truck and crossover ascension, imminent OEM specific redesign launches, the softening of used car prices and the leasing of pre-owned vehicles. We were able to discuss “his” industry in detail.

We kept the logic for adding Radio simple, focusing on three key fundamental laws of marketing:

-There is a point of diminishing returns, where no matter how much more effective any medium might be or perceived to be initially (in this case TV), there reaches a point when the next ad dollar would be better spent on another medium (Radio). The reason for this is straight-forward: TV duplicates more with itself after a certain point than it does with Radio, thus limiting reach.

Our point: Radio should not be added to the media mix only if there’s any “additional dollars” but should be added to the media mix to make their ad and TV spend more impactful.

-Each medium has its heavy and light users. This is true of TV, Newspaper, Digital and Radio. It’s no longer possible for any single medium to effectively do it all. The media landscape is simply too fragmented.

Our point: Reaching “many” is better than preaching to a “few”, particularly when it comes to automotive marketing, as those in the market for a new car are keenly attuned to automotive advertising, lessening the need for frequency. The reason, relevance. The goal, increased reach. Considerable frequency was required to “teach” us the multiplication table when we were younger but you don’t usually “teach” someone to buy a car if they are not currently thinking about or actively looking to.

It is life that puts the consumer in the automotive market (continually breaking down, etc.) and there are only so many of these new car buyers signing on the dotted line each week. Miss them and they are gone for years.

Reaching the heavy users of multiple media is always more effective than redundant frequency against the heavy users of any single medium, so to maximize the impact of an ad campaign, reach the heavy users of one medium then move on to the next one.

-Each medium’s heavy users have dramatically different qualitative profiles.

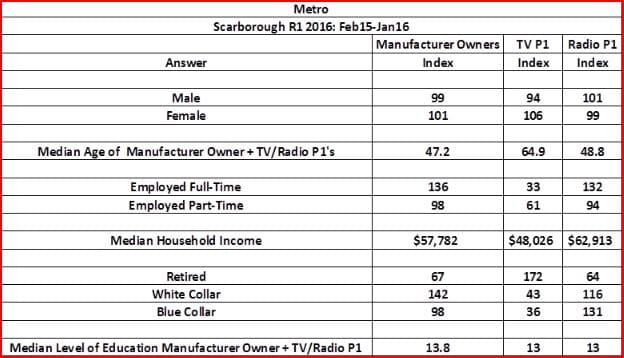

Our Point: Always match these heavy user profiles against the qualitative profile of the product being advertised, as these are the viewers/readers/listeners who will be exposed to the majority of paid gross impressions. So make sure that the heavy users of any medium that’s getting the lion’s share of a budget matches the profile of target customer. The first slide we discussed is below. We simply pulled Scarborough Instant Qualitative Profiles for this specific auto manufacturer as well as Instant Qualitative Profiles for the P1’s (the heaviest users) of Radio and TV and then cut and pasted them together into one spreadsheet. This took 5 minutes. Even just a quick glance at this chart, confirms the fact that the heaviest Radio listener is a considerably better prospect for these dealers than the heaviest TV viewer. In fact, the heaviest Radio listener profile and the dealer’s profile are virtually identical.

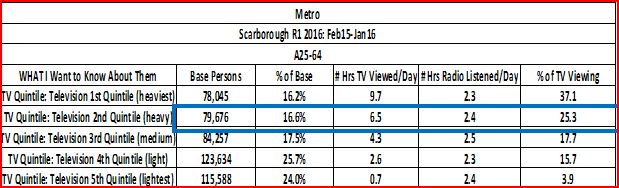

Our second slide highlighted the huge viewing disparity between the heaviest TV viewers in this market. Sixteen percent of their target demo watches TV 9.7 hours/day, while gobbling up close to 40% of all paid TV gross impressions. The lightest TV viewers, those 24% of 25-64 adults, view TV only .7 hours/day (42 minutes) while listening to Radio close to 2 ½ hours daily. The bottom line: Radio would generate much needed media weight against one quarter of their target who’s currently going virtually untouched by their TV campaign. Plus, qualitatively, Radio reaches consumers who are a much closer match to the individuals who buy the automobile being advertised.

We accomplished our goal and will now be presenting to the entire dealer group. This is the first step in a multi-step, strategic sales process but this data unquestionably got his attention, separated us from other Radio and media reps and contributed in securing the meeting. We’ve now begun preparing for that gathering.

Bob McCurdy is The Vice President of Sales for The Beasley Media Group and can be reached at [email protected]