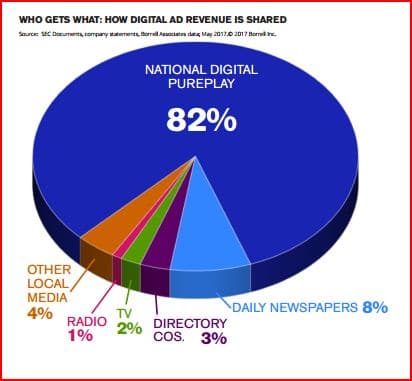

The new Borrell study gives four reasons why radio, TV, and print cannot keep up with the Facebooks, Googles, and Yahoos of the world. For example, in 2016 Gannett’s digital advertising dropped 7% and Yellow Pages digital was down 20%, while Facebook grew 62%. Here are the four reasons traditional media is being beaten to a bloody pulp when it comes to digital revenue, according to Borrell…

- They’ve relied almost exclusively on print or broadcast sales forces to sell digital products and have saturated their existing customer base. In other words, they’ve sold all the digital advertising they can to their own customers.

- They’ve tied too much of their digital fortunes to banners ads. Banner-laden websites are quickly becoming a thing of the past, especially with the migration of audiences to mobile devices, a banner-unfriendly environment. For instance, the desktop version of Philadelphia.cbslocal.com displays at least six banner ads, while the mobile version allows for one.

- They’re resistant to selling digital services. While these lower-margin products (SEO, website design, social media management, etc.) may seem to be a distraction, they’re becoming essential to securing a client’s overall business. Our 2016 survey shows that 77% of local advertisers are purchasing digital services, with website design and SEO being the most prevalent.

- They ignore digital-only sales opportunities. By focusing on “multiplatform” deals that sell larger ad packages that include print or broadcast advertising, they’re ignoring 35% of the active advertisers in a market that are not buying digital and traditional media together.

The only way for radio to fully monetize its advantage as the pre-need, pre-search, pre-purchase catalyst, and ongoing influencer, of the consumer buying journey, and jump radio’s flat-lining/continually-declining revenue stream, is to do what our advertisers continually tell us they want us to do, but what our industry refuses to do (the same advice applies to other traditional media):

SHOW THEM THE MONEY.

This means giving advertisers 52 weeks of documented sales results; directly attributed to our radio advertising. I do not know of one station in Canadian or American radio that does so. There should be 12,000+ that do.

Multiple systems, strategies and tools exist that are used by other marketers, but radio continues to do what it’s always done and fails, fails, and fails again to grow as an industry.

With or without radio stations, if one person on his own can generate millions of dollars of advertiser sales results in weeks, surely our wonderful industry can leverage billions in greater dollar commitments from a vastly increased number of 52 week clients.

Isn’t the most obvious answer that digital advertising, like radio (or any) advertising, first and foremost requires enough set of eyes/ears to make the buy effective? Think of how many sets of ears it takes to make a radio station a valuable buy for a business or agency. Sure, there are some niche formats that can generate revenue, but we all know the higher the listenership, the more revenue we generate. When it comes to digital assets, only the largest markets have enough users/visitors to even compare to a mediocre radio station. Just because digital advertising continues to boom, it almost exclusively booms big for big sites/platforms with large audiences.